Introduction to Anti-Money Laundering

Upon completion of this course, you will understand:

- key Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT) issues;

- what laws and regulations create AML obligations, and how they are similar internationally;

- various methods of money laundering, as well as areas and services that are especially useful to money launderers;

- key AML areas, such as AML controls and compliance, as well as risk factors that could be considered as part of a risk-based approach.

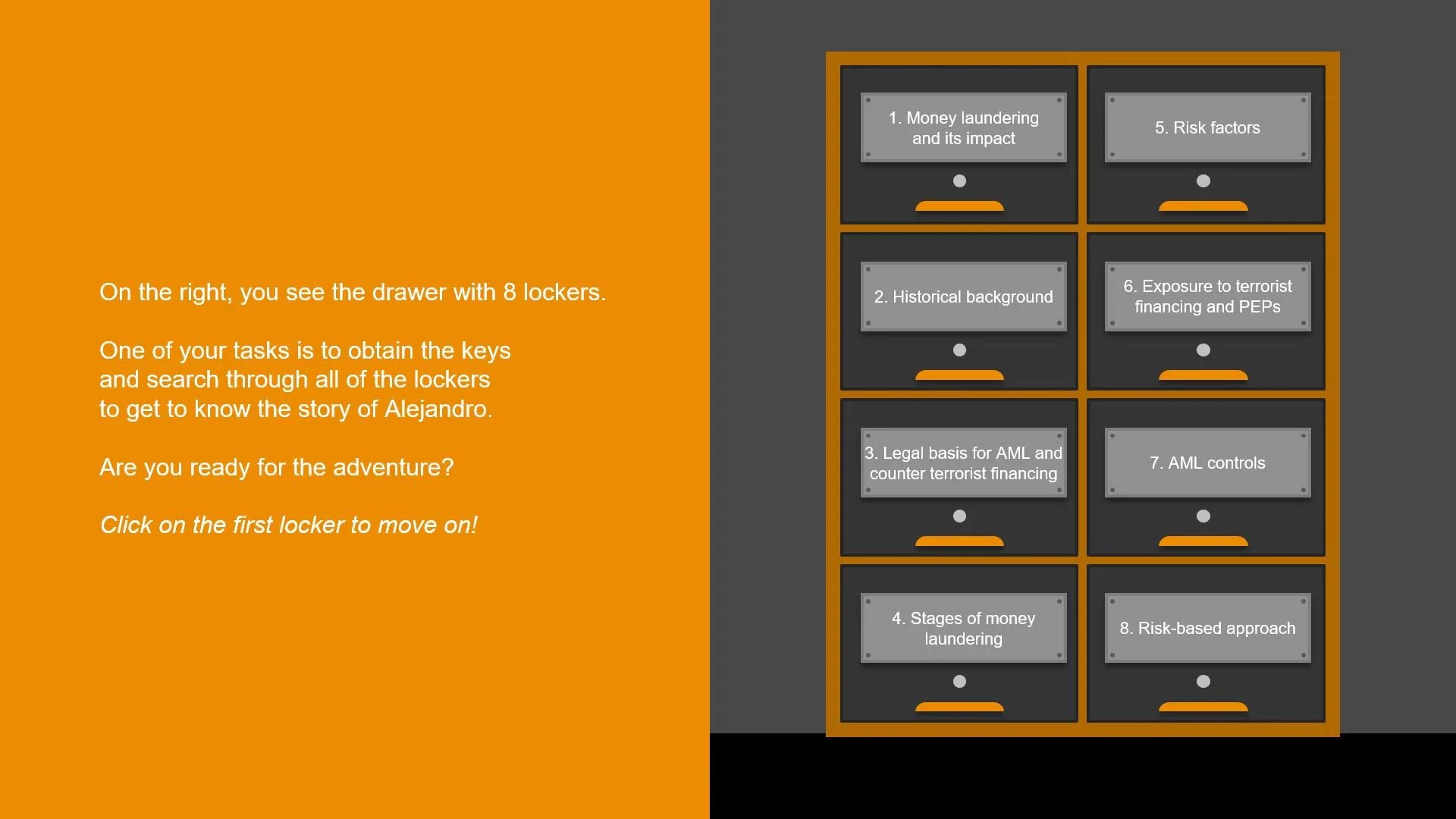

This curriculum consists of 8 modules:

- 1. Money laundering and its impact

- 2. Historical background

- 3. Legal basis for AML and counter terrorist financing

- 4. Stages of money laundering

- 5. Risk factors

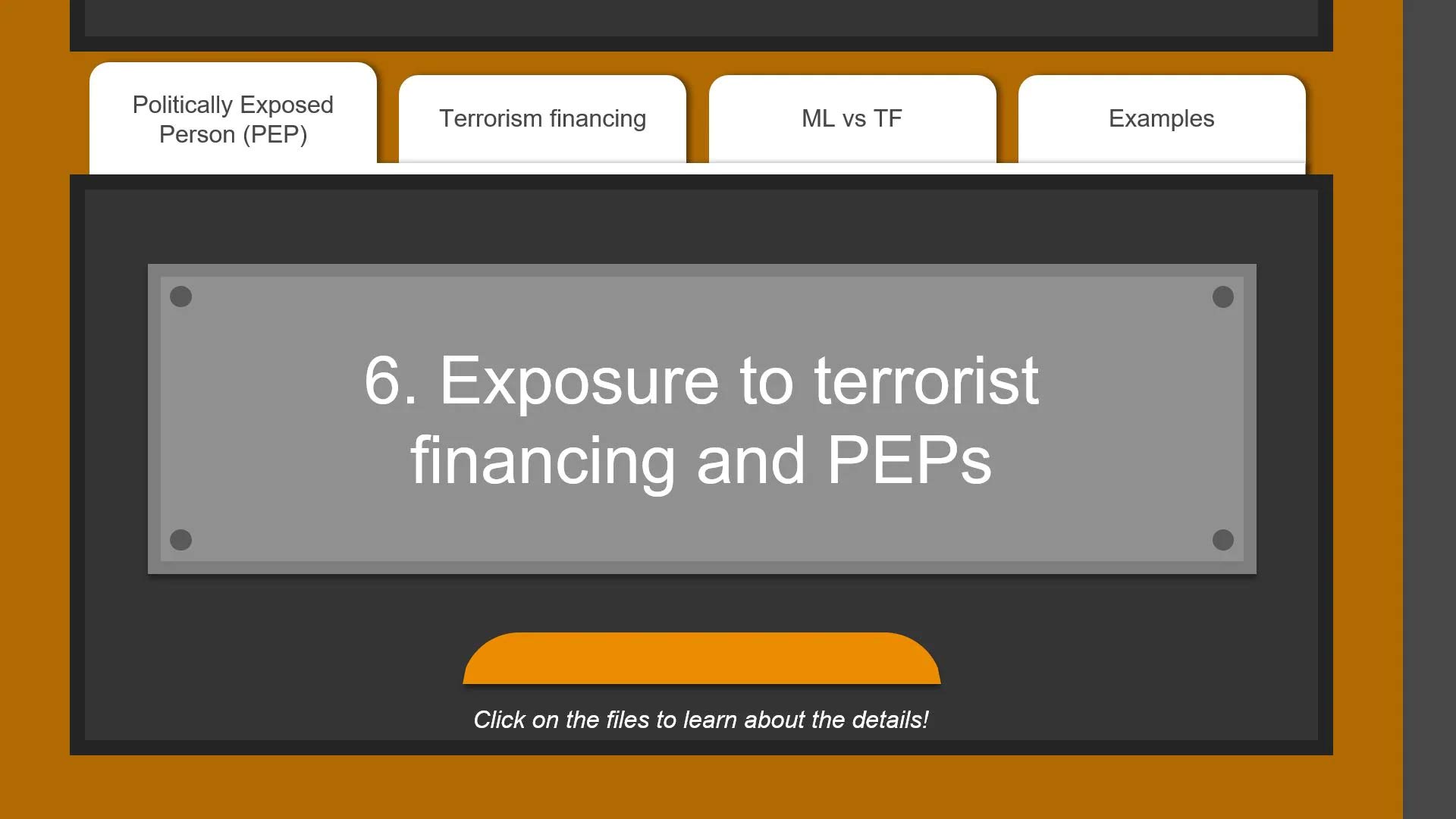

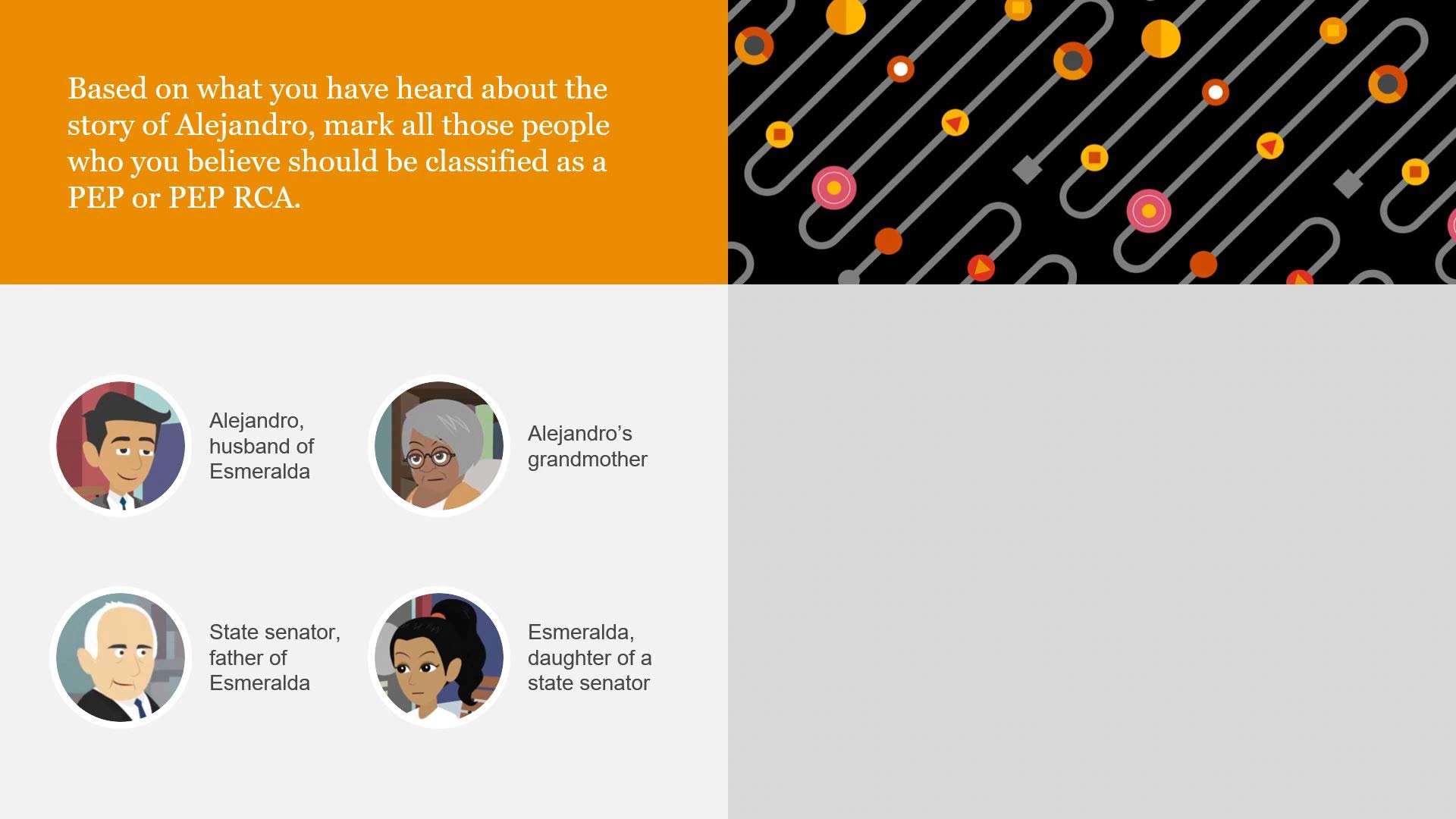

- 6. Exposure to terrorist financing and politically exposed persons

- 7. AML controls

- 8. Risk-based approach

Further information:

- Training hours: 2.5 hours

- Language: English